PROJECT

Description

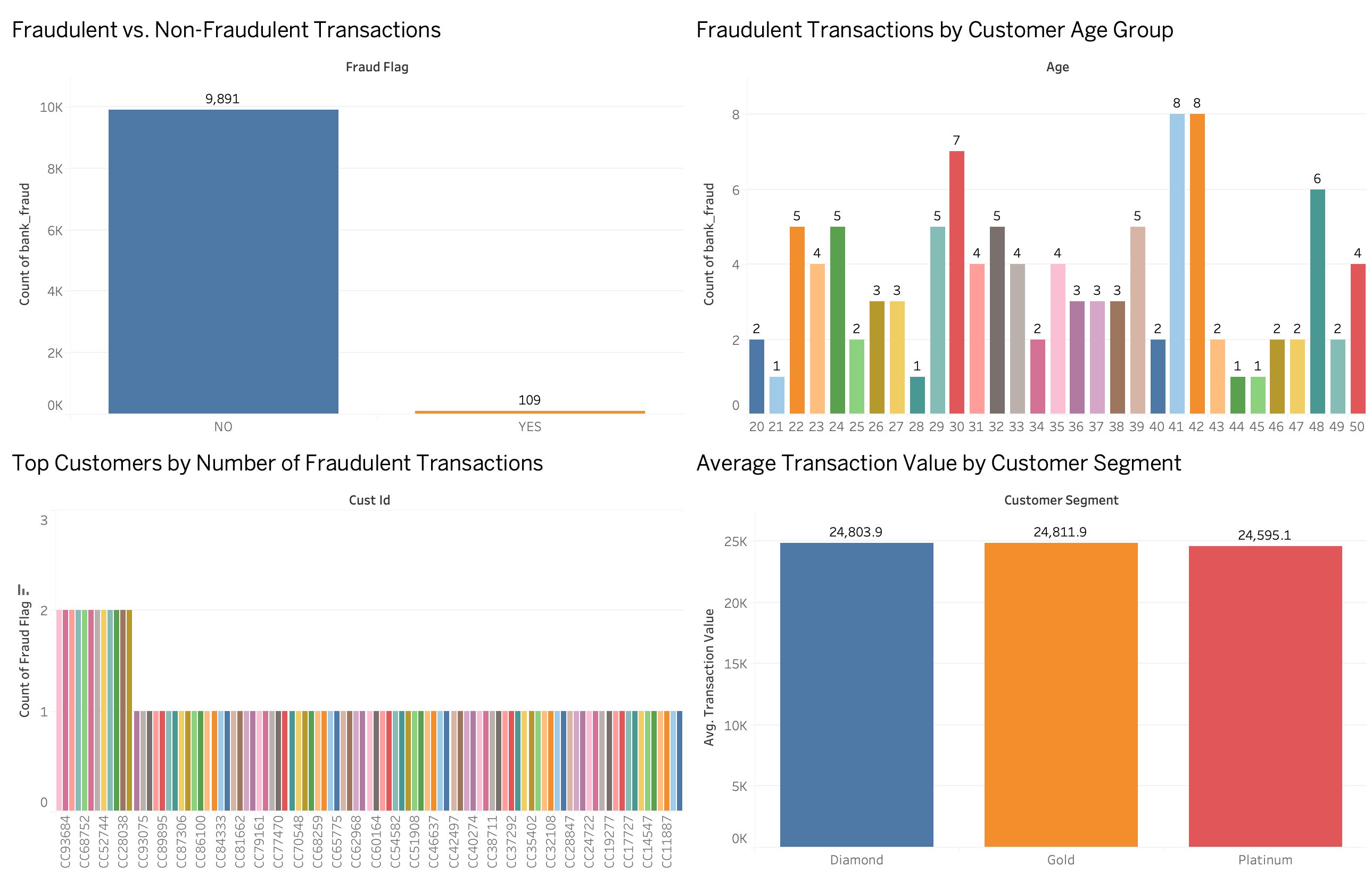

The Fraud Detection System is an advanced data analysis project designed to identify fraudulent credit card transactions by leveraging structured databases and SQL queries. It focuses on detecting suspicious activity in financial transactions by analyzing transaction data, customer demographics, and credit card details. The system uses a series of SQL-based joins and queries to consolidate and examine data across multiple tables, including transaction records, customer profiles, and fraud flags.

Core Components:

- Transaction Data – Captures details about each transaction, such as the transaction amount, date, credit card number, and customer ID.

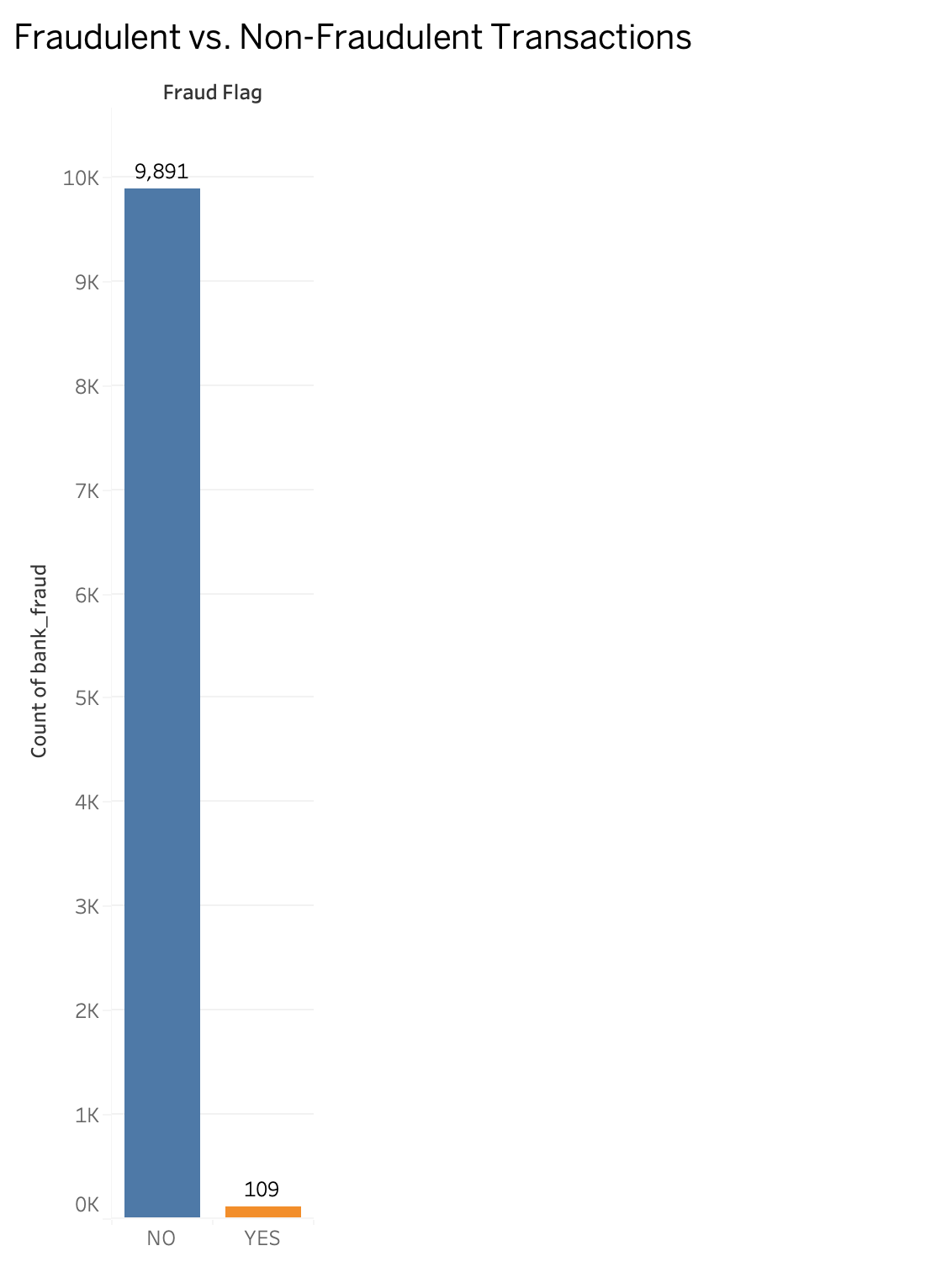

- Fraud Detection – Links each transaction to a fraud flag, marking it as either fraudulent or legitimate.

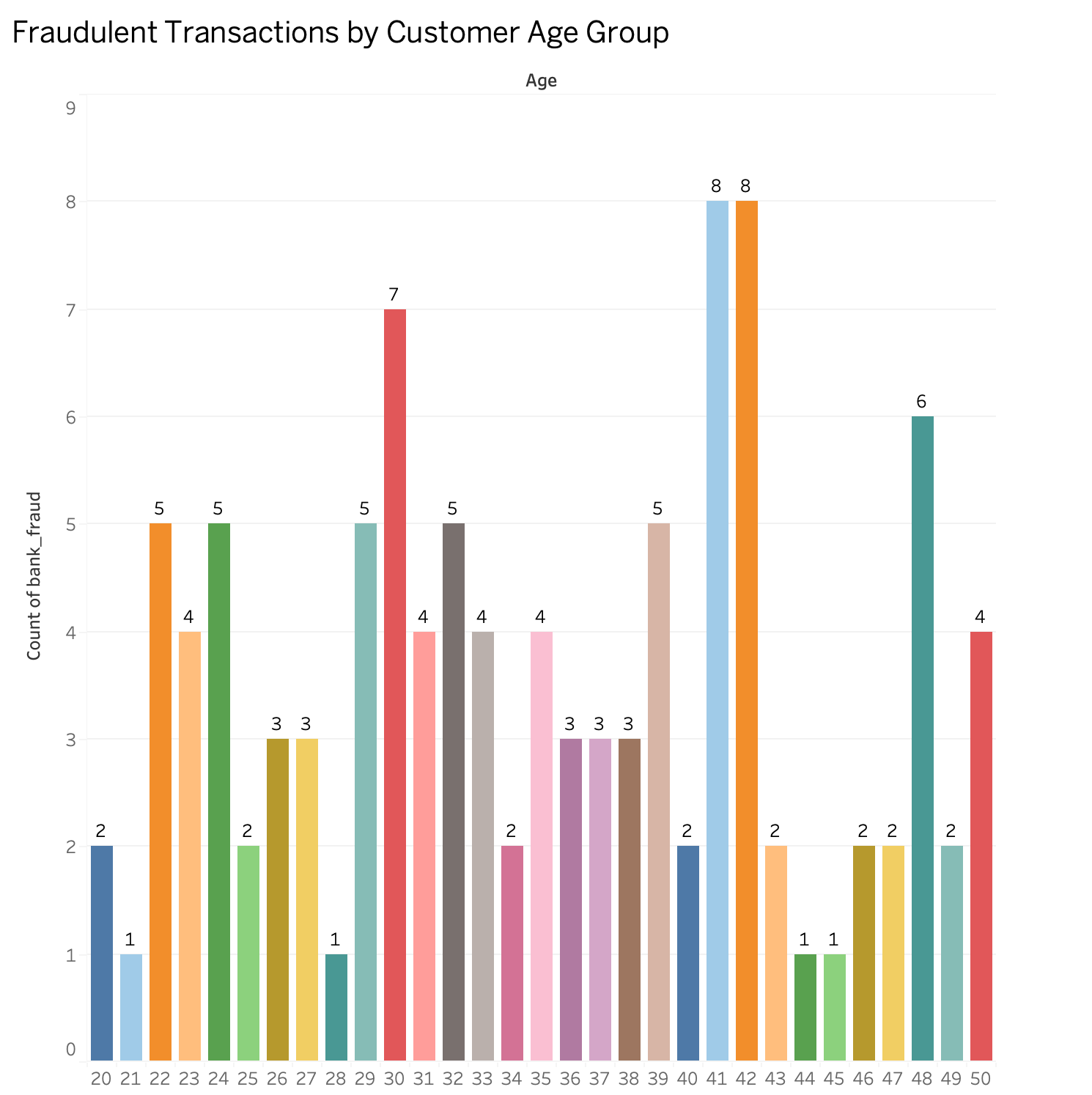

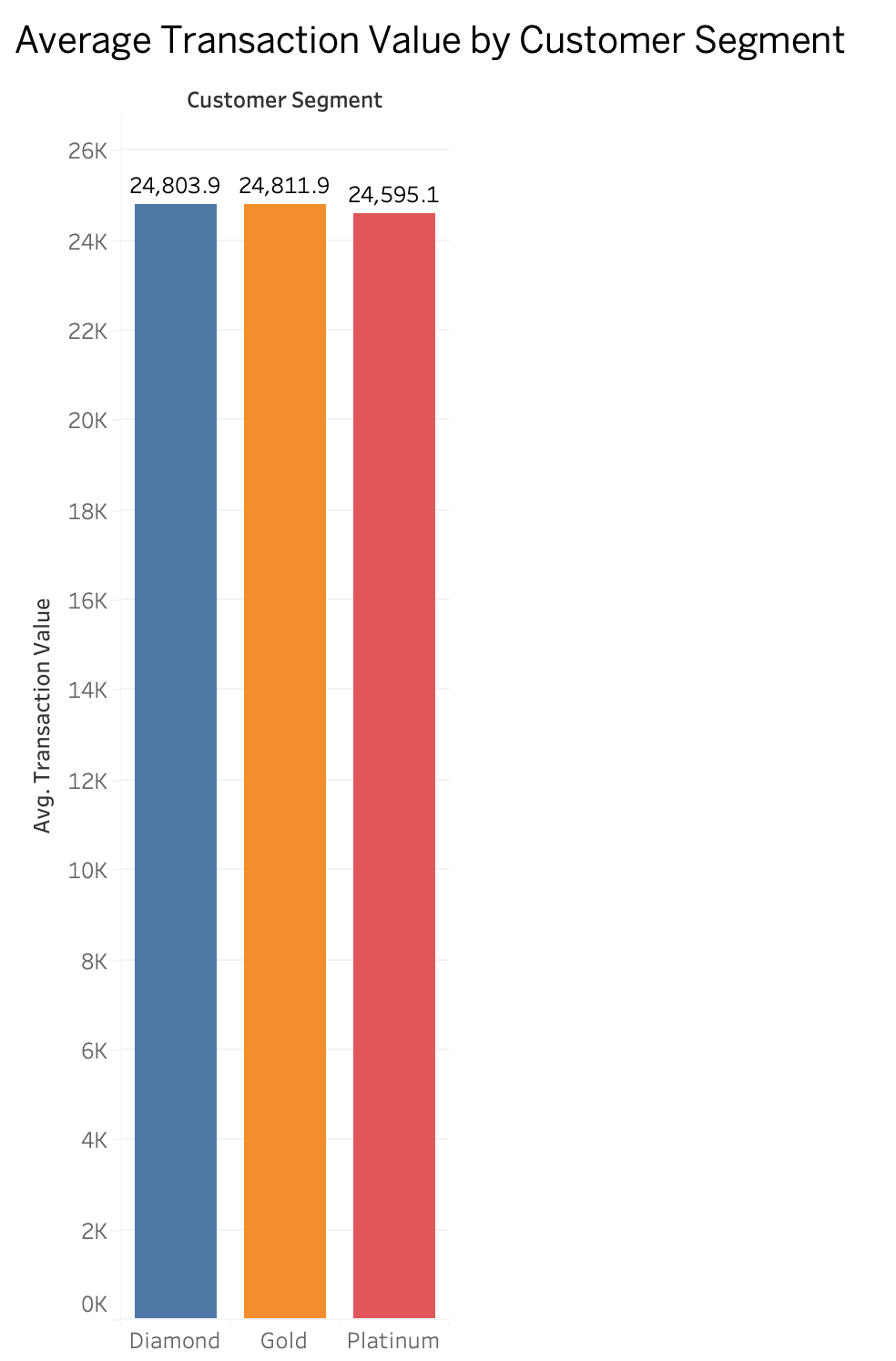

- Customer Information – Includes data about the customer’s age, segment, and credit history to assess their transaction behavior and potential risk.

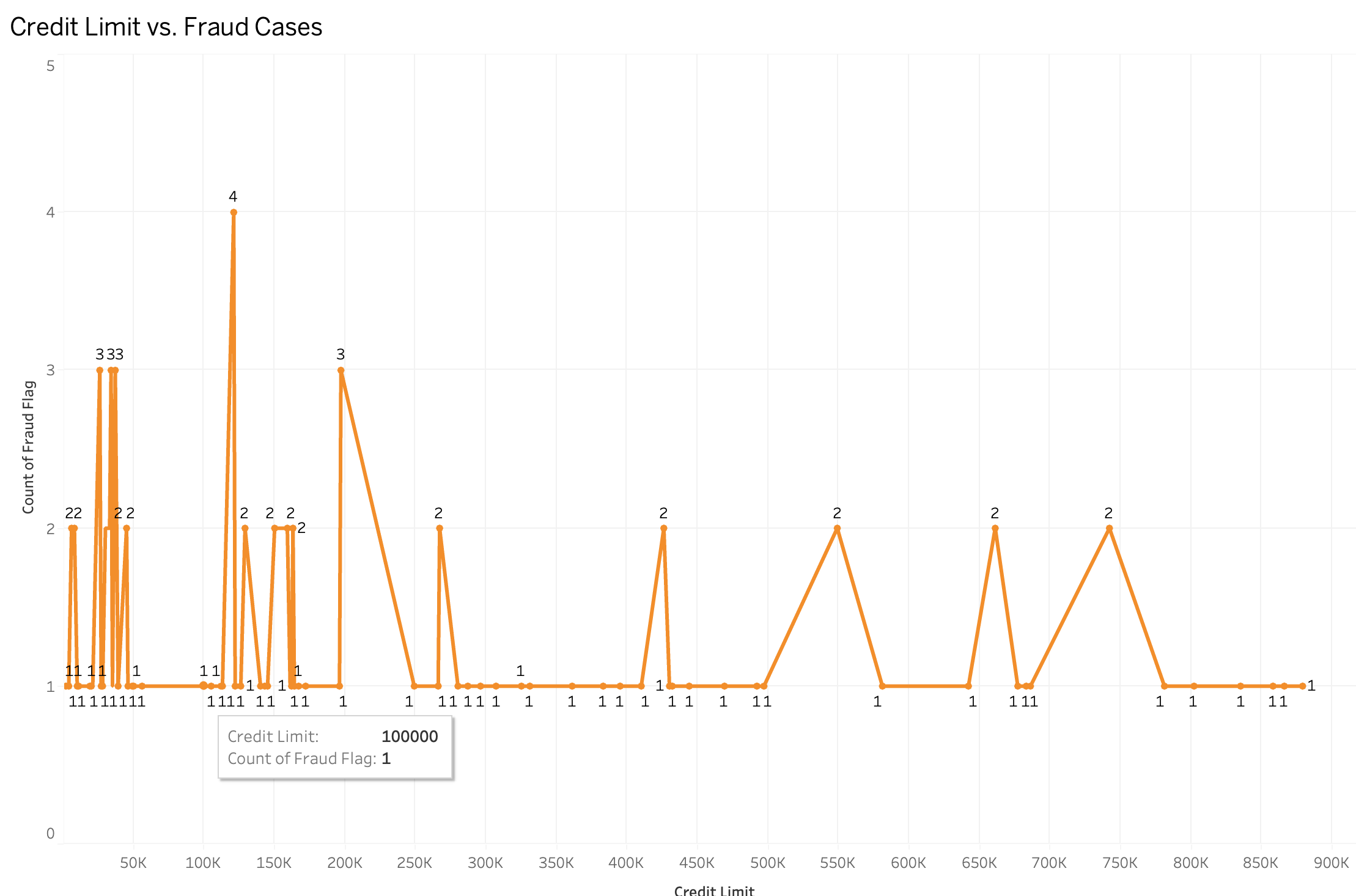

- Credit Card Information – Stores details about credit limits and cardholder information, which help in determining high-risk transactions.

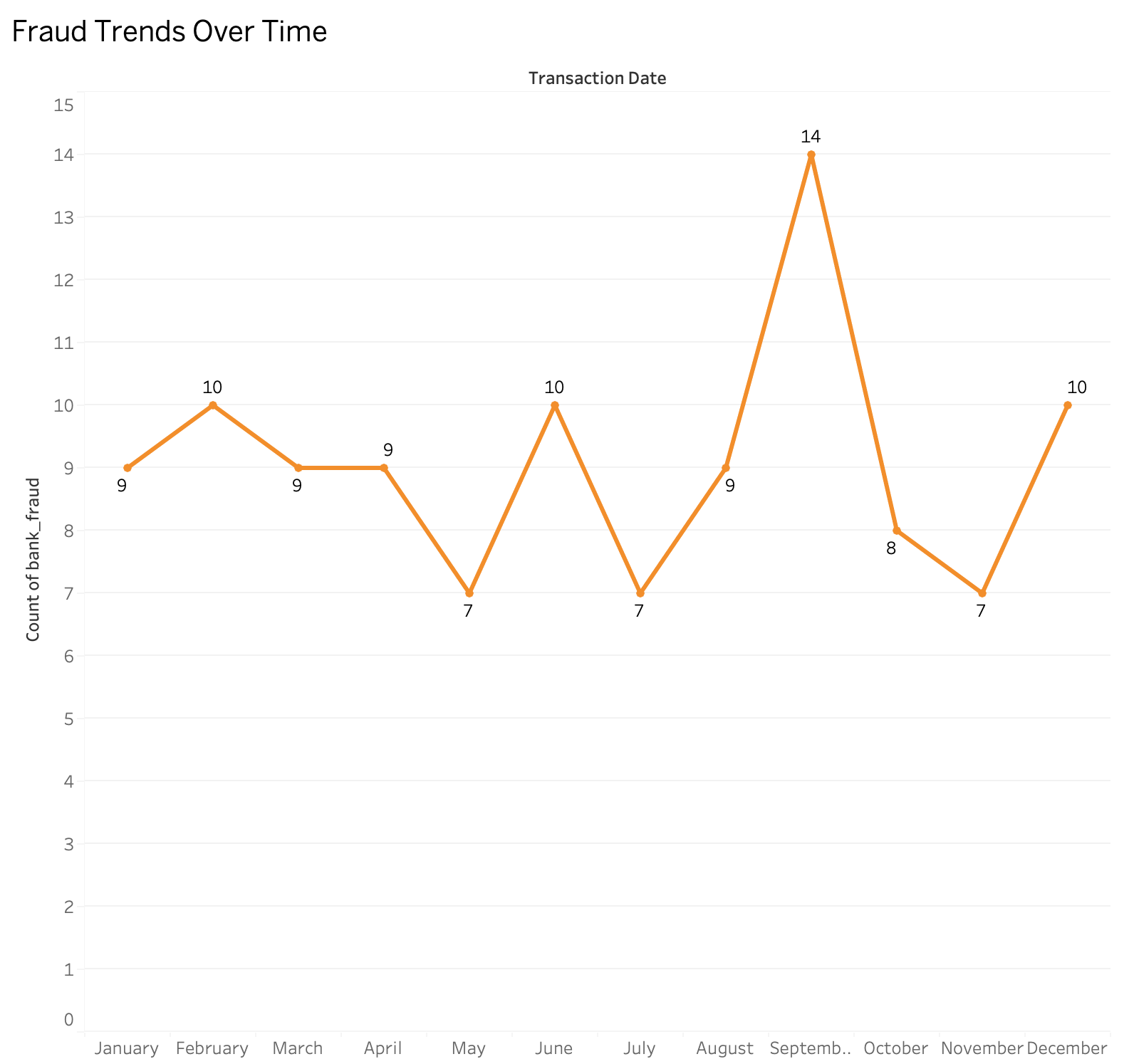

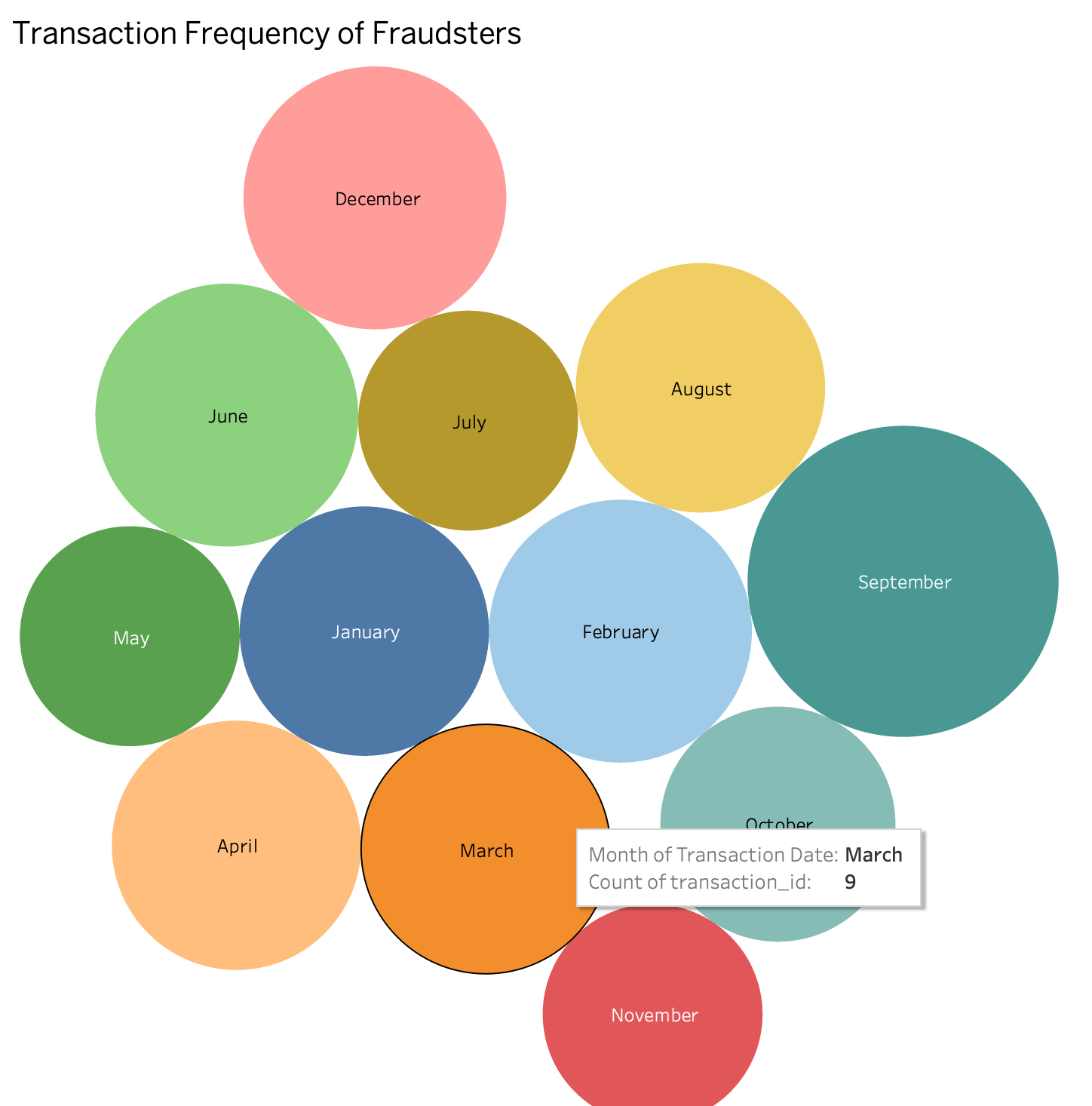

By combining these components, the system is able to analyze patterns in the data, such as unusual spending behavior, large transactions, or patterns indicative of fraud. The project also enables businesses and financial institutions to gain insights into customer spending habits, identify high-risk transactions, and reduce the likelihood of financial losses due to fraud.

The Fraud Detection System can be further enhanced through the use of data visualization tools such as Power BI or Tableau, which present the data in an easy-to-understand format, highlighting trends and anomalies. Additionally, the system can incorporate machine learning models for predictive analysis, improving its ability to flag fraudulent transactions in real time.

This project serves as a comprehensive solution for fraud detection, utilizing a combination of data science techniques, relational database management, and automation to protect both consumers and businesses from financial crimes.

Python Code

SQL

-- Create a new database called 'fraud_project'

CREATE DATABASE fraud_project;

-- Select the 'fraud_project' database to use it for queries and table creation

USE fraud_project;

-- Retrieve all records from the 'customerbase' table

SELECT *

FROM customerbase;

-- Retrieve transaction details along with fraud status

SELECT transactionbase.transaction_id,

transactionbase.transaction_date,

transactionbase.transaction_value,

fraudbase.fraud_flag

FROM transactionbase

LEFT JOIN fraudbase

ON transactionbase.transaction_id = fraudbase.transaction_id;

-- Retrieve all records from the 'customerbase' table again

SELECT *

FROM customerbase;

-- Create a new table 'bank_info' by joining multiple tables to consolidate data

CREATE TABLE bank_info AS

SELECT customerbase.cust_id, -- Customer ID

transactionbase.transaction_id, -- Transaction ID

customerbase.age, -- Customer Age

customerbase.customer_segment, -- Customer Segment

transactionbase.transaction_date, -- Date of transaction

transactionbase.transaction_value, -- Transaction amount

cardbase.credit_limit, -- Credit card limit

fraudbase.fraud_flag -- Fraud status (flag)

FROM customerbase

INNER JOIN cardbase

ON customerbase.cust_id = cardbase.cust_id -- Match customers with their cards

INNER JOIN transactionbase

ON cardbase.card_number = transactionbase.credit_card_id -- Match cards with transactions

LEFT JOIN fraudbase

ON transactionbase.transaction_id = fraudbase.transaction_id; -- Attach fraud details if available

-- Drop the 'bank_info' table (removes it permanently)

DROP TABLE bank_info;

-- Convert 'transaction_date' format to a standard date format

UPDATE bank_info

SET transaction_date = STR_TO_DATE(transaction_date, '%d-%b-%y');

-- Ensure 'transaction_date' is stored as a proper DATE type

UPDATE bank_info

SET transaction_date = DATE(transaction_date);

-- Retrieve all records from 'bank_info' after modifications

SELECT *

FROM bank_info;

-- Show the structure of the 'bank_info' table

DESCRIBE bank_info;

-- Modify the 'fraud_flag' column to store text values instead of boolean

ALTER TABLE bank_info

MODIFY COLUMN fraud_flag VARCHAR(3);

-- Update fraud flag values: change '1' to 'YES' for better readability

UPDATE bank_info

SET fraud_flag = 'YES'

WHERE fraud_flag = 1;

-- Update fraud flag values: change '0' to 'NO'

UPDATE bank_info

SET fraud_flag = 'NO'

WHERE fraud_flag = '0';

-- Retrieve all transactions flagged as fraudulent

SELECT *

FROM bank_info

WHERE fraud_flag = 'YES';

-- Count the number of fraudulent transactions

SELECT COUNT(*)

FROM bank_info

WHERE fraud_flag = 'YES';